Market Overview – Morning Express

Market Overview – Morning Express

E-mini S&P (September) / NQ (September)

S&P, yesterday’s close: Settled at 4141.25, down 90.25

NQ, yesterday’s close: Settled at 12,909.75, down 358.75

Fundamentals: The healthy pullback finally arrived. How fitting, right? The S&P rallied from extreme negativity, when investors were crying uncle, and stopped right at the 200-day moving average, just as many bears were throwing in the towel. The one theme that threads this all together, what we have been talking about since April, the ‘Inflation Showdown at Jackson Hole’. On Friday, Fed Chair Powell will deliver his much-awaited keynote speech. The Federal Reserve has used the Jackson Hole Symposium to deliver, in many ways, monumental policy announcements. Just over the last two years, the bank announced ‘symmetrical inflation targeting’ in 2020, allowing inflation to run as hot as it did cold, and decided to stand strong in their path of easing last year. Of course, the former led to the latter and the Fed is now battling unprecedented and historic waves of inflation. Over the next two days, leading up to Chair Powell’s speech on Friday, we will examine the direction in which we believe the Fed will go from here.

Do not miss our daily Midday Market Minute, from yesterday.

Today’s economic calendar brings flash PMIs. Germany surprised by only marginally contracting at 49.8 versus 48.2. This underpinned a firmer Eurozone read at 49.7 versus 49.0. Although Eurozone Services PMI did expand at 50.2, it came in below the 50.5 expected, with Germany’s 48.2 (49.0 exp) contraction weighing it down. The largest surprise this morning came from the U.K., where Manufacturing PMI contracted with 46.0 versus 51.0 expected. The U.S. is on deck, due at 8:45 am CT, followed by New Homes and Richmond Fed data. The U.S. Treasury will auction $44 billion 2-year Notes today, $45 billion 5-years tomorrow, and $37 billion 7-years on Thursday. Also, Minneapolis Fed President Kashkari will speak at 6:00 pm CT.

Technicals: Price action is working through corrective selling. Overnight, the low pinged 4124.50, the gap settlement from the day before CPI, however, it will be more critical to test and hold intraday. Previous support at 4138.50 will act as our Pivot and point of balance, similar to that for the NQ at 12,924. Continued action below 4138.50, without a semi-significant bounce from 4124.50 support will encourage added selling. This would open the door to a test of major three-star support in the S&P and rare major four-star support in the NQ at … Click here to get our (FULL) daily reports emailed to you!

Crude Oil (October)

Yesterday’s close: Settled at 90.36, down 0.08

Fundamentals: Crude Oil is pressing out above Friday’s failed high of 91.69 after strength was reinvigorated by jawboning from the Saudi Oil Minister. He noted the Oil market is overlooking limited spare capacity and there is a disconnect between futures and physical that may force OPEC+ to tighten output. Oh really? We have been pointing to this disconnect for months as the White House unloads SPR at a record pace. Furthermore, in the expectation of a politically orchestrated price suppression in Gasoline, stations waited to re-stock supply at better prices, drawing down tanks in the meantime. There have now been 70 straight days of lower Gasoline prices at the pump and coincidentally Gasoline inventories have been drawn down by 9.62 mb over the prior two weeks. All things considered, there is a clear disconnect and Saudi Arabia, enjoying the $50 billion profit from Aramco last quarter, clearly wants to defend the price of Oil from the mid-80’s and we find this very bullish.

Early estimates for tomorrow’s EIA report are -1.5 mb Crude, -1.833 mb Gasoline, and +0.267 mb Distillates.

Technicals: Last week, we reinvigorated a more Bullish Bias and today’s strength out above major three-star resistance is beginning to confirm it. This previous major three-star resistance will serve as our Pivot and point of balance on the session, with prices holding out above here, we believe it paves a path to our next upside target at … Click here to get our (FULL) daily reports emailed to you!

Gold (December) / Silver (September)

Gold, yesterday’s close: Settled at 1748.4, up 14.5

Silver, yesterday’s close: Settled at 18.878, down 0.191

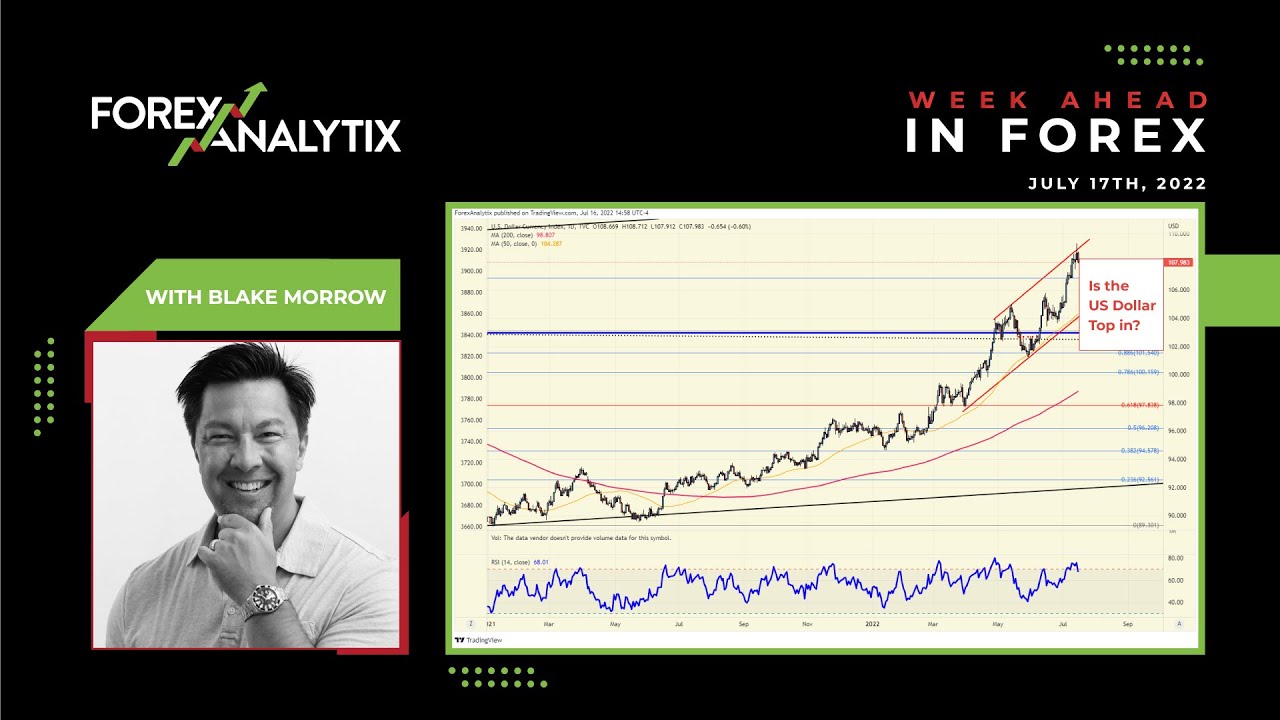

Fundamentals: As we noted here yesterday, the U.S. Dollar strengthening against the Chinese Yuan has been a direct headwind weighing on the precious metals landscape. The USDCNH broke out yesterday and extended gains on today’s session before peeling back (and developing a potential spinning top). The Dollar has also strengthened above parity against the Euro and the Dollar Index as so far Pac-Manned the July 14th high of 109.14. Added headwinds have come in the tune of rising yields on fears of a more hawkish Fed at Jackson Hole and added supply hitting the market this week (highlighted in the S&P/NQ section). It is all about the Fed’s messaging this week. Today, we look to U.S. flash PMIs at 8:45 am CT.

Technicals: Gold and Silver have so far responded at the exact spot they must. This is the July 27th pre-FOMC announcement settlement, major three-star supports at 1737.5 and 18.60. We will again reintroduce a cautiously Bullish Bias given this significant level of support and the fact it held yesterday. There are reasons to believe the precious metals complex can consolidate higher into Friday. Despite the hold, so far, both still face tremendous damage and strong overhead resistance. To show signs of life, Gold must clear major three-star resistance at … Click here to get our (FULL) daily reports emailed to you!

https://www.bluelinefutures.com

20220823