Italy’s debt could be a worry for the Eurozone

Italy’s debt could be a worry for the Eurozone

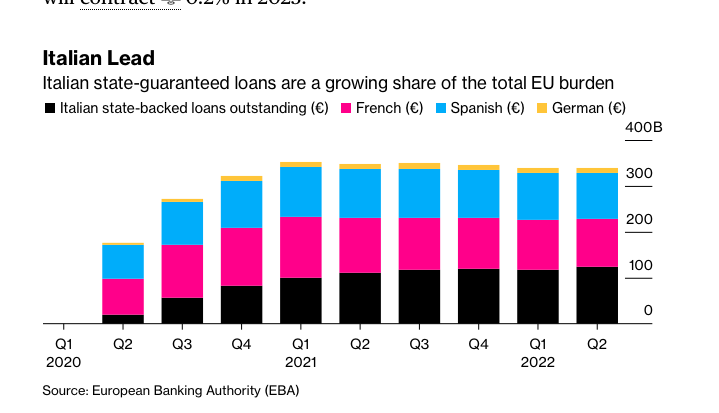

Bloomberg reports that Italy has a €123.2 billion debt mountain from COVID-backed state support which, as of June 30, is outstanding. The debt has been rising too as it has increased from the previous quarter of €118 billion. Despite not being the largest country it has the largest government-guaranteed debt yet to be repaid in the Eurozone. Check out below the growing level of Italian debt from the state-backed loans.

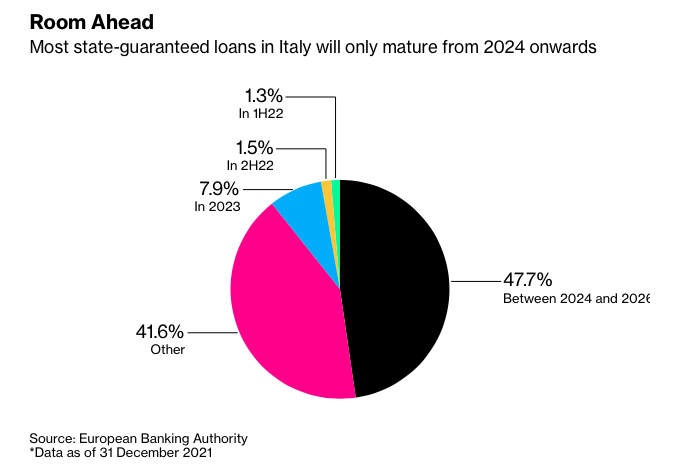

The problem that is building is that the energy crisis is lingering on, inflation remains high, and Italy is expected to contract 0.2% in 2023, according to the IMF. This means that the debt burden can be a growing political worry as more and more companies will struggle to meet repayments on many of these loans (just under 50%) as they mature from 2024 onwards.

So, on one hand, this is not an immediate risk for the euro. However, the market is sensitive to Italian debt and if this looks like getting out of control it could start to weigh on the euro over the medium to longer term. The environment which will make this worse will be if the Russia-Ukraine crisis goes on, energy prices stay high, Italy’s economy contracts, and inflation pressures remain elevated. This would be the environment that would pressure not only Italy, of course, but the whole Eurozone. However, Italy’s debt problems have been a major factor for the euro in the past and this risk should be monitored in case it accelerates. Bear in mind that the bite of this risk would not really be felt until we approach 2024, so it is a risk in the medium-term horizon. You can read the full Bloomberg article here.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinions of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.

20221130