How the Last Canadian Jobs Print Impacted the CAD?

A catch up on the CAD

The big picture for the CAD has been as follows. April’s BoC meeting was a hawkish tilt (on an unexpected QE reduction) and saw the CAD gain rapidly. Take a look at the USDCAD chart and see the gains the CAD made.

However, with so much strength being priced into the CAD the July BoC meeting saw some of that strength fade. Even though the BoC once again cut its QE rates by $1 billion a week the bank reminded the market that the recovery still requires extraordinary policy accommodation. This allowed the CAD to further lose some of its strength from April.

CAD is more neutral now, but broad outlook is positive

The outlook for the CAD is more neutral now as it is really wanting a fresh catalyst for its next direction. Oil prices have had a good recovery from 2020 lows and that supports the CAD. Oil prices directly impact the CAD, so any fluctuations in oil are felt by the CAD.

Friday’s weak jobs

Last Friday saw a weak Canadian jobs report. The headline was looking for a gain of 150K. The employment print was a miss at 94K and unemployment picked up to 7.5% from a 7.4% expected. Now, this miss should not alter things. The gain in jobs that was there was mainly in the full-time sector and amongst the group that the BoC wanted to see coming back online. The young and ‘core-aged’ females (25-54), so that will be encouraging. July employment gains were concentrated in full-time work (+83,000; +0.5%); the first increase since March 2021. Unemployment among youth aged 15 to 24 fell by 54,000. You can dig into all the detail here.

The bottom line

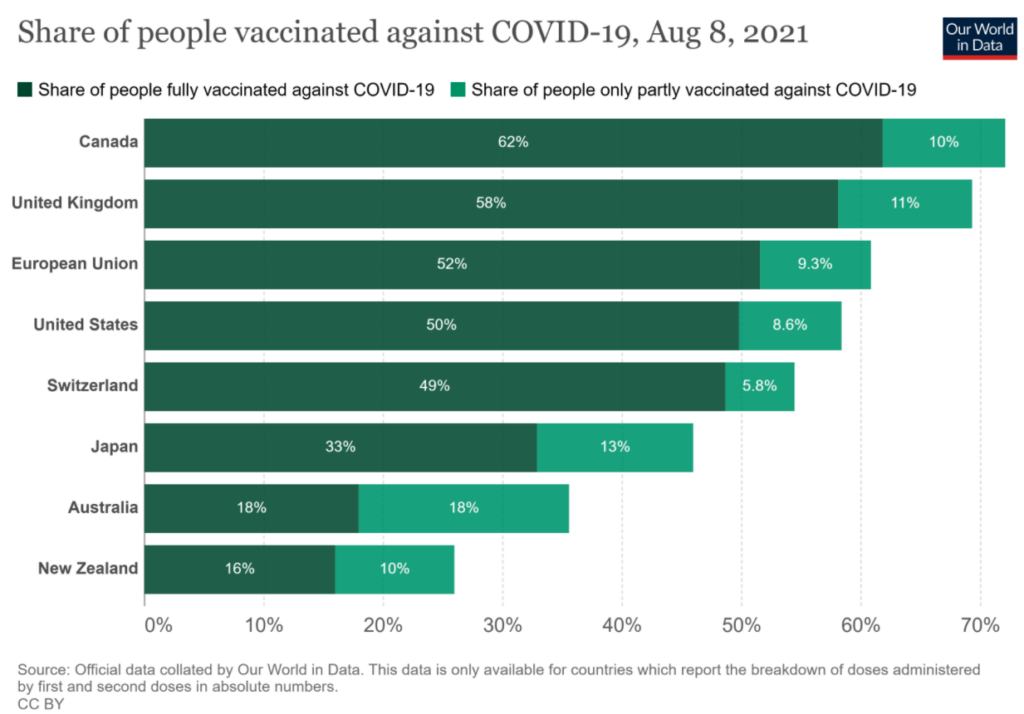

The broad outlook for CAD remains good. Look to buy the CAD against any currency that suddenly has reasons for weakness as the excellent vaccination program in CAD should mean that little de-rails the recovery.

So, CADJPY medium term looks sensible as long as the risk tone does not badly sour. Also, keep an eye on oil developments.

Giles Coghlan