Growth Risk Key Question for the Second Half of 2022

Growth Risk Key Question for the Second Half of 2022

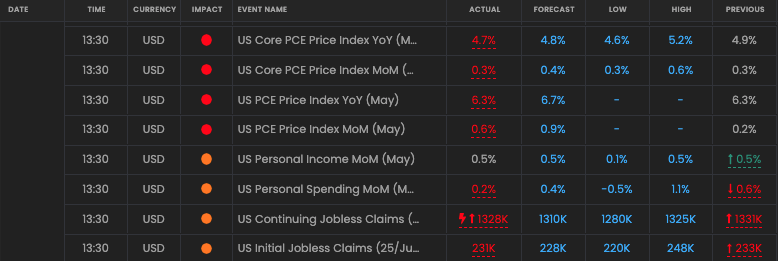

As we start the second half of 2022 investors remain focused on these major fears outlined in our previous article. However, the growing risk for the second half of 2022 is starting out to be over recession worries. The latest core PCE print from the last day of June would have provided some relief as the headline print came in below forecast at 4.7% vs 4.8% forecast.

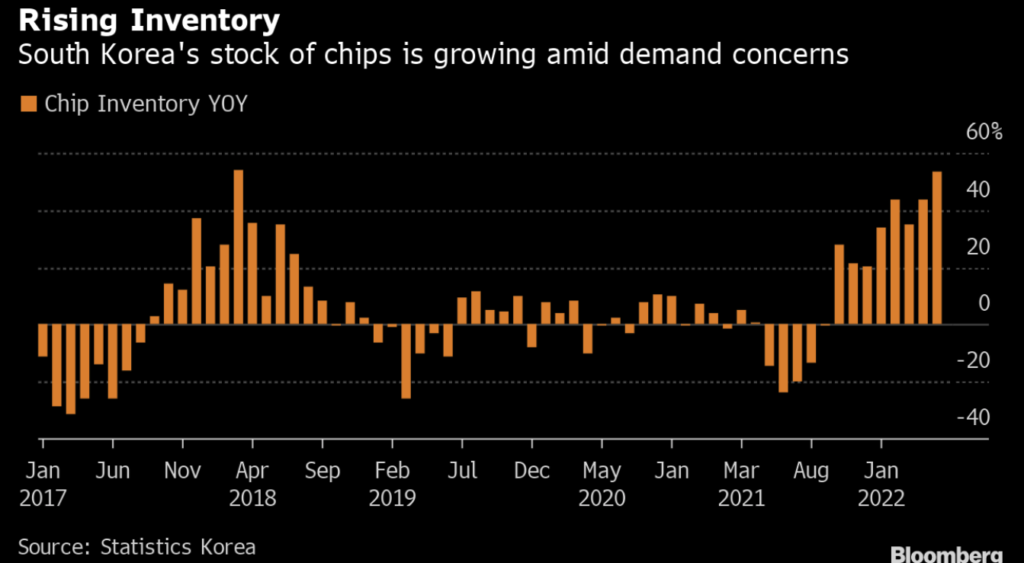

So, inflation fears can take a step back as we start 2022. However, growth fears cannot. Copper prices have fallen on slowing growth worries and industrial metals have been falling over the last few weeks too. Commodity markets are sensing a slow down in demand. Oil markets, with their disparate drivers, have also been showing signs of weakness. Similarly, we see some signs of inventories rising. Here is a quick snapshot of South Korea’s chip inventory. You can see that the chip shortage can quickly be replaced by a glut in chip supply.

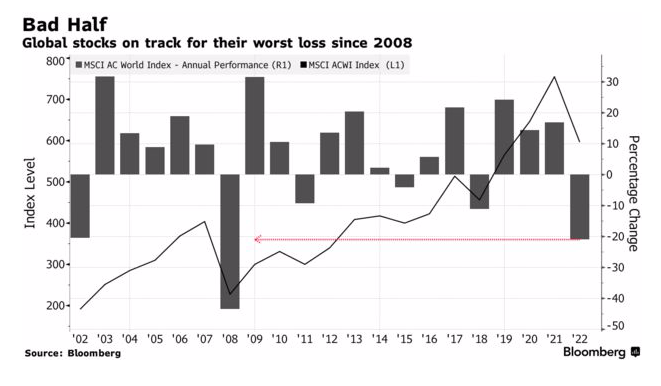

These narratives are not new. This is what many canny investors have been fearing from the start of the year. You can see this chart from Bloomberg illustrating stocks on track for their worst drop since 2008 below. Now in one sense that is not so surprising given the huge amounts of fiscal and monetary policy support during COVID’s surge. The prospect of the central bank’s hiking into slowing growth has been the cause for stock falls.

So, as inflation fears fade – growth worries will not. So, where will the turning point be for stocks to start gaining again? Most likely at the first point where investors sense that central banks will be pausing interest rate hikes to allow growth to recover. Look at these key tech levels ahead on the Dow. Some inverts will use key tech levels to manage risk once/if the monetary policy tide has turned.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

20220704