FOMC Preview – Taper Talk and Impact on Dollar

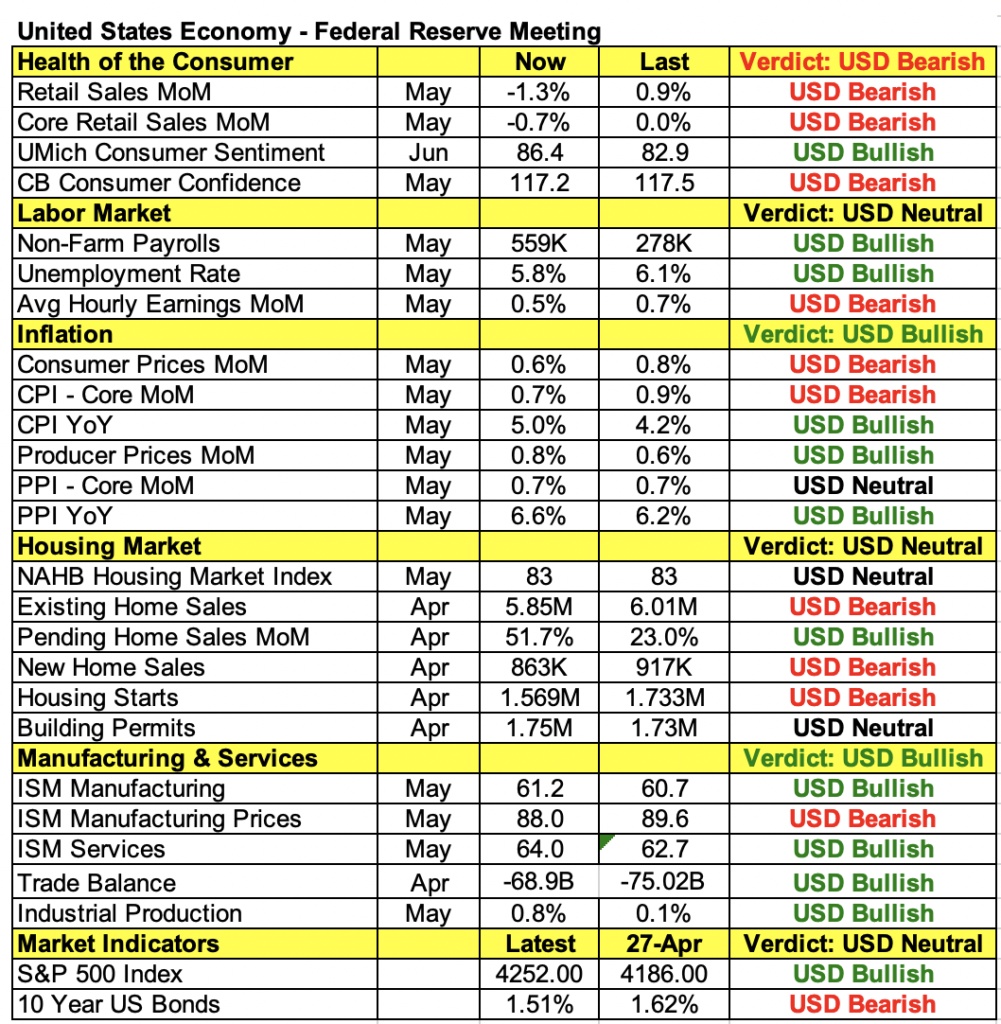

The outcome of Wednesday’s Federal Reserve monetary policy announcement could set the stage for how the U.S. dollar and currencies trade over the next month. With that in mind, the greenback maintained its bid ahead of rate decision. USD/JPY hovered near 2 month highs above 110 as EUR/USD held below 1.2150. Today’s U.S. economic reports were supposed to have a big impact on trader positioning into FOMC and the fact that investors ignored weaker reports is an important sign of how sentiment is skewed into the event. They continue to look past weak data in favor of rising prices and a stronger recovery.

Retail sales fell -1.3% in the month of May, which was significantly weaker than anticipated. With declining auto supply, economists forecasted a decline in spending but they expected retail sales ex autos to rise by 0.2%. Unfortunately core retail sales fell -0.7% as consumers shift spending from goods to services. Demand for home improvement gave way to more experience spending on restaurants and lodging. Manufacturing activity in the NY region also grew at its weakest pace in 3 months according to the Empire State survey. Yet the dollar’s buoyancy tells us that investors expect the Fed to cave to rising prices and address rather than avoid the issue of reducing asset purchases, especially with producer price growth hitting a record high.

Investors need to beware of the potential for disappointment from the Fed. U.S. policymakers have insisted on every occasion that the rise in prices is transitory and will fall as pent up demand and supply chain disruptions ease. The prospects for the recovery are strong, but consumer demand and job growth over the past 2 months have been subdued. Like the ECB who avoided taper talk last week, if the Fed is cautious, they’ll want to wait for real data improvements before admitting that it is time to start talking about tapering their $120 billion a month bond buying program.

On the one hand however market conditions are ideal for taper talk to begin. Stocks are strong, volatility is low and investors are optimistic which provides cushion for a deep correction. By vaguely mentioning that they are looking into reducing bond buys, they give investors an entire summer to discount the changes before the Fed’s Jackson Hole summit in August.

With no changes in monetary policy expected, the main focus for investors tomorrow will be the Fed’s dot plot forecast and Fed Chair Jerome Powell’s press conference. Any discussion of adjusting the pace of bond purchases will be revealed in Powell’s speech and clarified in the Q&A. Back in March when the Fed’s economic projections were last updated, the dot plot showed a split of 11 to 7 against a 2023 interest rate hike. Now, it is widely believed that the forecasts will shift to tightening next year. If you are trading FOMC, here’s the rundown of what will happen tomorrow:

The U.S. dollar could see an initial pop at 2pm NY if the dot plot shows expectations for the first rate hike shifting to 2023. After that we expect consolidation with a bias to the upside before Powell speaks. If he acknowledges the need to begin taper talk, EUR/USD could drop towards 1.20 and USD/JPY could make a run for 111. However, if he avoids talking taper and downplays the immediate need to discuss reducing asset purchases, effectively doubling down on their view that inflation is transitory, the dollar could fall quickly and aggressively.

Regards,

Kathy Lien Managing Director of FX Strategy BK Asset Management

http://www.bkassetmanagement.com/