Dollar Outlook: What’s Going On?

Dollar Outlook: What’s Going On?

Since the start of February, the USD has enjoyed a resurgence on a string of data points showing that the US may still need more rate hikes to contain a strong US jobs market in particular. The strong January jobs report released on February 3 gave the USD a strong boost. The US Services PMIs released on the same day gave it extra legs as investors considered that the strong US economic outlook may need the Fed needs to do more to hike to contain inflationary pressure. Recent data has also supported this initial response.

Key technicals to note

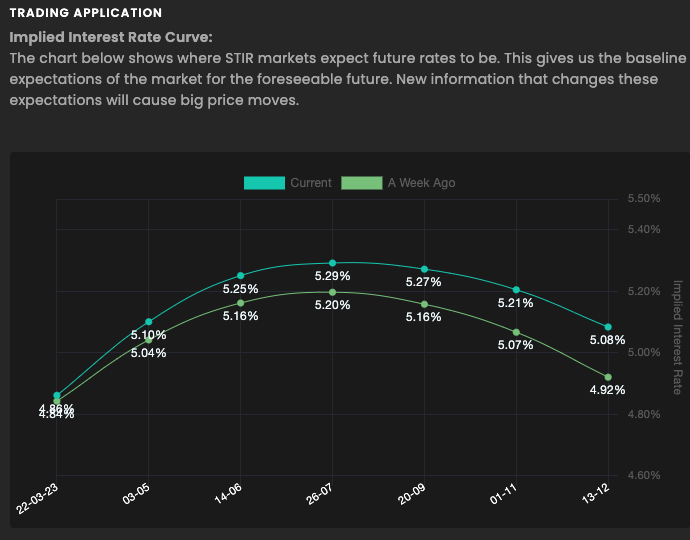

The recent strong data from the US has resulted in STIR markets re-pricing a more aggressive Federal Reserve. Markets at the start of this week now expect a terminal rate of 5.29% and then one rate cut into the end of this year. (At the start of the year it was a terminal rate of around 4.89% and two rate cuts at the end of this year). See the STIR market implied base rate for the US from the Financial Source Interest Rate Tracker below:

Technically, the USD is heading into some very stiff resistance around the 105 index level. This is a large supply level from the start of the year and an area where the 100 and 200 EMA converge. It will be difficult for the USD to push above this level with so much extra hawkishness being priced in for the Fed since early Feb. Not impossible, but it is a natural roadblock now for recent USD bulls.

The takeaway

Watch the USD around this level closely and watch the narratives. If the narrative changes and the Fed start to signal a pivot then that should act as a natural stop placement level with stops placed above 106 on an index reference point. If the Fed turns more hawkish and if US inflation continues to get worse then watch for tripping stops above the supply level marked around 105.75. The simplest way to trade the dollar is usually through the EURUSD pair due to the very close inverted relationship between the two. So, a DXY long would be a EURUSD short and vice versa. We are now at a key technical inflection point, so the risk can be simply managed here.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

20230221