China’s Back! But it May be Inflationary

China’s Back! But it May be Inflationary

The news this week that the IMF lifted its global growth projections was largely placed at the feet of China’s Covid Zero pivot. The IMF raised its 2023 growth forecast to 2.9% from 2.7% citing China’s re-opening as a key reason.

Inflationary forces?

The news over China’s pivot has been gathering pace since the end of last year. Remember that China’s command economy would mean abrupt u-turns are problematic from a messaging point of view. The reaction to the Covid protests around the same time the world cup was broadcasted, when people were freely mingling, was about as close to a pivot being signaled as we were going to see. However, Kristina Georgevieva, the head of the IMF, pointed out that there is a double-edged nature to China’s re-opening. It may be inflationary. So, if demand for oil once again rises and that boosts oil prices then that also increases global inflationary pressures.

A fair point to watch

It is not impossible to see a sudden surge in demand domestically in China too as restrictions being lifted allow pent-up savings to be spent. Last year China’s trade surplus rose 31% y/y as exports increased by 7%, but imports only rose by 1%. This reflected the opening up of other major world economies even as China remained under a range of restrictions.

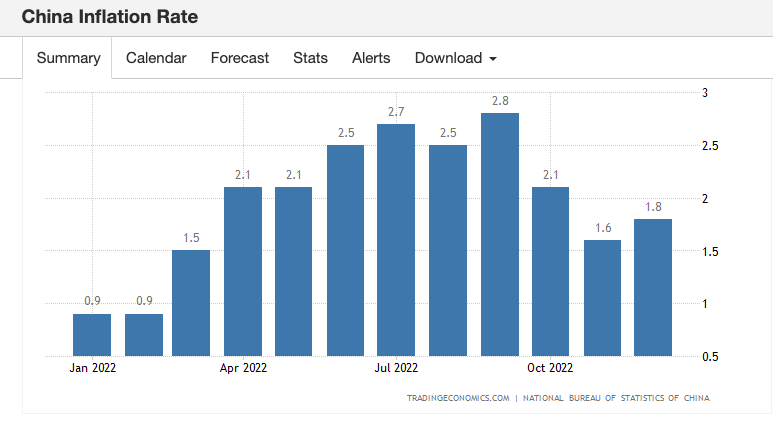

China’s headline inflation print for Decemver 2022 was at 1.8% and that is down from a 2.8% peak in September 2022, so there is no sign of major concerns there just yet. However, it will be worth watching.

China’s re-opening can benefit oil

So, keep an eye on oil prices too as this will be a key inflationary force. Higher oil generally means higher inflation forces as costs are injected into economies. Oil markets have formed a key technical Head and Shoulders bottom on the daily chart and news of China being back for business could well be the catalyst oil needs to break higher over the coming weeks. See here for an explainer video on how to trade the Head and Shoulders pattern.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

20230202