Central Banks vs Governments: The Market Volatility will come from their War

Central Banks vs Governments: The Market Volatility will come from their War

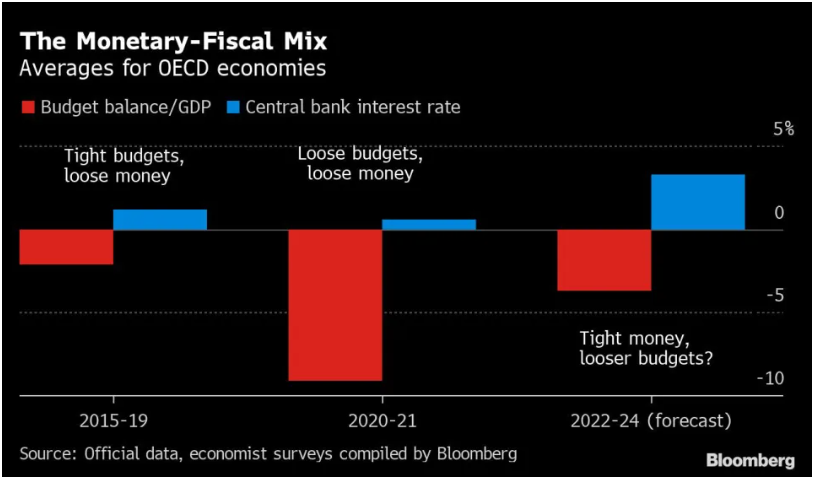

During the economic situation of the pandemic, governments and their central banks had the same goals. Now they are starting to move in different directions. This inevitable war already has a victim. It’s called, Great Britain.

The UK’s attempt to boost its economy with fiscal stimulus failed, triggering a bond meltdown. In the short term, the Bank of England was forced to step in and support the markets, while the Liz Truss government partially reversed course. In the medium term, investors are betting that this will mean higher interest rates for the British.

When monetary authorities see prices spiking, they see inflation that needs to be stamped out – driving economies into recession if necessary. But politicians in charge of budgets see it differently, because voters hit by a cost-of-living squeeze expect their governments to help, which usually means more spending or fewer taxes. That’s exactly what many of them are doing – especially in Europe, where gas shortages caused by the war in Ukraine threaten blackouts and blackouts this winter.

Germany alone plans to borrow up to 200 billion euros to deal with the energy crisis. Elsewhere, Japan is adding more fiscal stimulus and many countries have increased food or energy subsidies. All this points to a new policy mix that diverges from the recent past. In the decade or so between the collapse of Lehman Brothers and the arrival of Covid-19, governments often put the brakes on their economies with fiscal austerity, while central banks – without much success – tried to step on the gas.

Now it looks like those roles will be reversed, perhaps in part because the legacy of the financial crisis was criticism that governments bailed out banks but not workers. The new regime is full of risks:

- Public spending can fuel price pressures that monetary authorities are trying to contain

- When central bankers raise interest rates, they add to fiscal costs as governments pay more to borrow

- Periods of market chaos come when it is unclear whether fiscal or monetary officials have the upper hand – especially if there is speculation that central banks are bailing out governments’ coordination

The unsustainable debt reveals that in several major economies from the Group of Seven countries as a whole, interest payments on public debt are set to reach 3.6% of economic output by 2030, more than double the pre-pandemic level. Italy, like the UK, has a new government with ambitions for a more expansionary fiscal policy. France and even the US could be next, knowing that the US ran the largest budget deficit in the world during the pandemic. They also decline faster than many of their counterparts.

And as an oil and gas-producing giant, which earns more from exports as prices rise, the U.S. is not facing the kind of crisis that is pushing energy-importing Europe into the new fiscal stimulus. Even so, there is potential for the kind of turmoil that has engulfed the UK.

The crisis of hysteria in the bond market could pass to the American continent, although at the same time that the biggest buyers of government bonds – including the Fed – are retreating. And the budget deficit is set to do the same, with tax revenues at significant risk if economic growth continues to slow.

The World Bank warns that a synchronized withdrawal of monetary and fiscal support could lead to a global recession next year. In the long run, central bankers probably won’t succeed and may have to settle for inflation above their 2% targets.

With interest rates and inflation structurally higher over the next decade than they have been in the past, there will be headwinds for the valuation of financial assets – from stocks to bonds – which have soared in the era of central bank dominance.

Interested in more technical analysis as well? Check our USDJPY and GBPUSD outlooks below

USDJPY Elliott Wave Analysis

USDJPY climbed a lot in the last 12 months, above 150, to a 24 year high, with price moving into some multi-year resistance when looking back to 1998 and 1990 highs. The main reason for such an impressive USDJPY rally is of course the hawkish policy by the FED, while BoJ sticks to their easing policy. BoJ easing policy is also one of the reasons why interventions work only temporarily. We have seen a new intervention this Friday, but not really sure if this one can turn the trend around. Technically we are seeing nice five waves up from 2021 low, meaning trend is in late stages of a recovery, but for a major reversal here we need FED to slow down their hawkish look and BoJ to do more regarding the JPY weakness.

GBPUSD Long-term Elliott Wave Analysis

Cable dropped to an all-time low after a real capitulation back on Friday, Sep 23rd and then Sunday/Monday open, when pair fall to 1.05. We have seen a sharp drop to a multi-year low, and towards the trendline of a big wedge pattern which we highlighted as an important zone when the breakdown occurred. So far, we can see a nice bounce, back above that line so it appears that more upside can follow in weeks maybe months ahead, especially if USD will come down from resistance with US yields on speculation that FED can be looking to slow down the hawkish look after next hike or two.

by Grega Horvat and Stavros Chanidis

Have a nice weekend,

Grega

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.

The Trader Funding Program. Trade and receive 75% profits. LEARN HOW

Register for EW-Forecast Macro Views

Love what we do? Please follow us twitter. https://twitter.com/GregaHorvatFX

20221024