A Changing Economic Landscape

A Changing Economic Landscape

Operating in a world awash in debt has become an art form. The most significant modern-day innovation of our times that has allowed us to play this game so far for so long is floating currency rates. This fact is least appreciated. In the old regime, a bust would have appeared somewhere in the world. The smooth management of things like monetary policy and liquidity on a real-time basis is unimaginable. In all of this, everyone is trying to guess which way liquidity conditions are headed and what the impact will be on equity prices. The perma-bears looked at US reserve assets for years and predicted that the day this ends… you know the rest. Others said this is the road to hyperinflation. Twenty years and going, neither has happened. Even Japan has survived. So we have to focus on the rate of change of growth, the existence of liquidity, and where it’s going. That is the only thing that can keep us on the right side of financial markets making money. And we need to be fleet-footed. No narrative that we believe in today may be true tomorrow. The entire setup changes, and we have to adjust quickly. One day the FED is tapering, and the next thing, they are back to cutting rates and reverse repo’s. There is no perma anything that works. So a lot has changed in the last quarter of 2022, and let us go down that hole.

We can go all over the world searching for liquidity. Should we look at reserve assets+tga+rr or global liquidity, including central bank liquidity created by ECB and BOJ? So why not just the dollar, which is the world’s reserve asset and whose rise and fall shrinks liquidity for everyone?

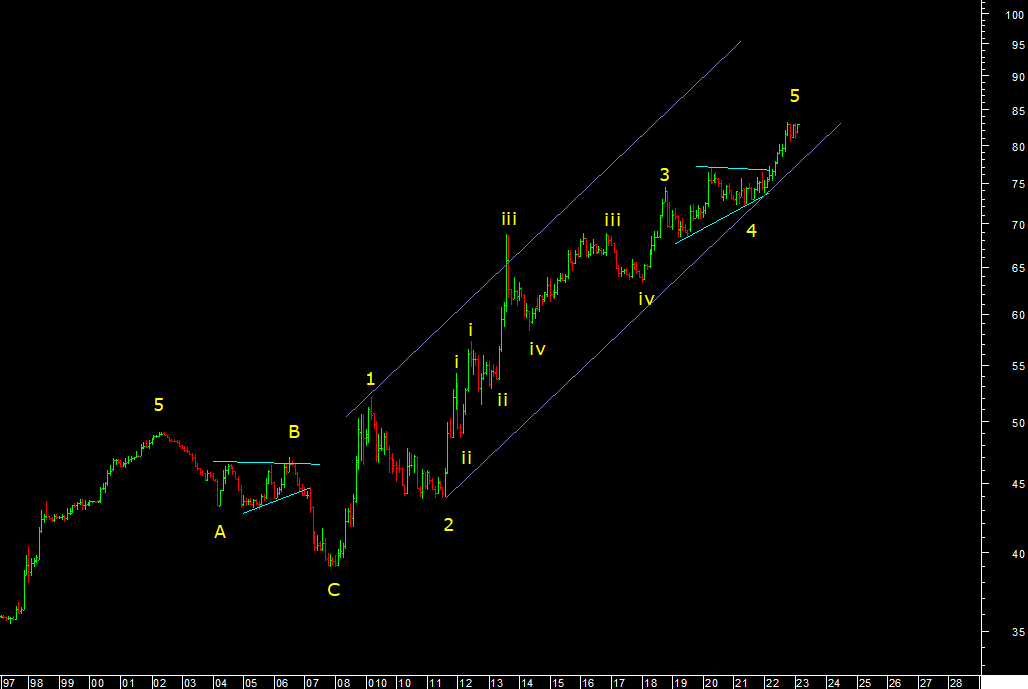

So, in the end, was the big spike in the dollar in 2021 real? For the time that we managed to hold above the double top of 103.8 made in 2017 and 2020, it was a breakout. Now it is a false breakout or, simply put, the end of a 5th wave of the entire move higher starting in 2011, as seen below.

Yes, the FED stated it was tightening, but BOJ just bought the highest amount in monthly bond purchases. 182$ billion in Jan 2023. Add to that, China, in its reopening trade, added another 450$ billion. Yes, now it’s China’s turn to do the stimulus that everyone else has done already. Europe finally stopped buying bonds in Sept after inflation crossed 10%, but China can stimulate Europe as they are significant trading partners. End of the day, if one or the other global economic power is adding liquidity, global liquidity is not going down. I will post an updated chart if someone shares it.

The liquidity aspect takes care of the risk of market crashes and currency collapse somewhere in the world. Now once we have that in place, we want liquidity to go into the right things. Surely we do not want it to be headline inflationary. With Oil at 85$ after hitting 135$ a year back, we have significantly taken care of one aspect. The streets’ calculations are that inflation will come down to 3% core by June 2023, and then god knows. OK.

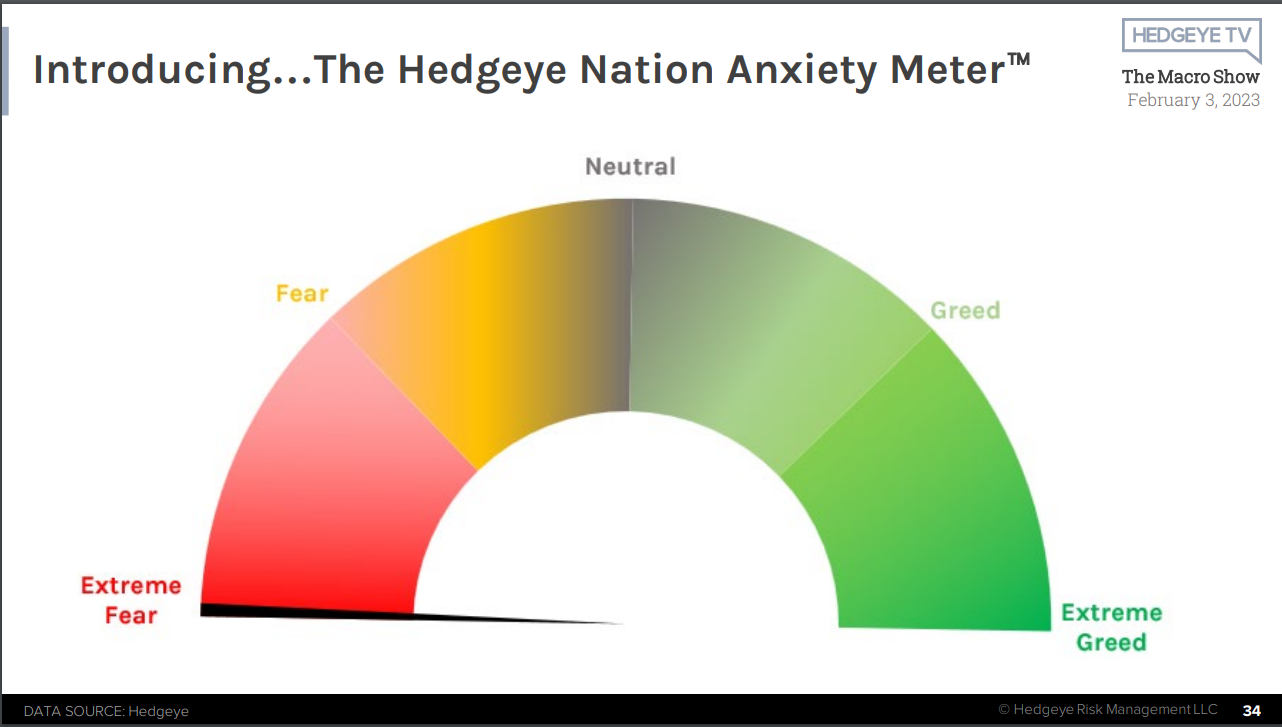

By then, if the FED does not pivot, we will have an economic problem of an actual recession that everyone and his uncle already predicted at the end of DEC 2022. The anxiety that was only showing up in the CBOE put/call ratio now shows up in this new indicator from Hedgeye. On 3rd FEB, it hit the highest ever on record. I do not know what it means yet because there is no historical data. But fear is not what makes market tops, and the reading is lower today but still in the red fear zone.

Bitcoin is also the anti-dollar where Bitcoin is as inversely correlated to the dollar as Gold. Its performance has overtaken gold on the upside so far. So when BTC stops falling and builds a nice rally, we start thinking about what has changed in global liquidity conditions.

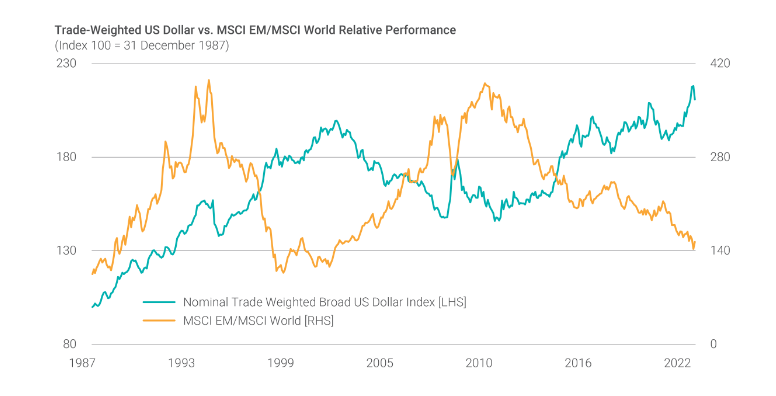

The US is keeping interest rates high in what is a very liquid world. This reminds me of 2001-2007, and what happened there is that the US economy slowed down the pace of growth, and liquidity [falling dollar] went into other parts of the world. Mainly emerging markets. Sure, some of it created the Housing bubble in the US too, but US equity market performance was nothing to talk about.

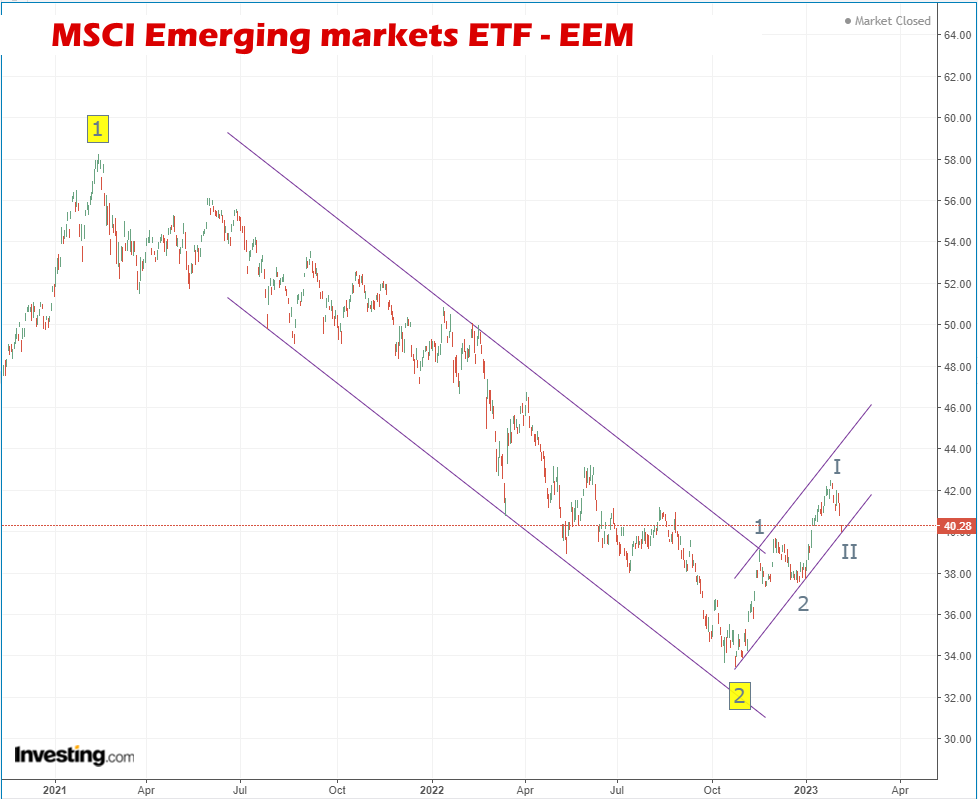

This has been a long time coming. Emerging markets may once again start to outperform advanced economies. India also might outperform the USA. Liquidity will flow away from USD into other assets. Commodities gold and Emerging markets. So the trend reversal that we have seen in the EEM index is real.

The ratio chart of EM/S&P below in yellow shows that periods of the falling dollar are associated with periods of EM outperformance when the yellow line goes up. The yellow line is now near where I was in the last bull cycle in 2001. The setup is for the start of an Emerging markets bull run. If the US market does nothing and the dollar is quiet, the rest of the world will take a bath in liquidity. Countries like India, with the right business environment and demographics for growth, should be the lead runners in this race. In hindsight, the Adani crisis will then end up being a smokescreen.

You may wonder how we will transition from what looks like a certainty of a recession in the US to growth. The answer lies in mild and bearable inflation backed by government spending on infrastructure and Capex. In his interview yesterday, the FED chair made it clear that the goods inflation was transitory or based on covid lockdown effects. That ended up rubbing off on services. In other words, he does not think its structural. I think there are problems, but AI has ensured that we need less and less labor to produce goods over time. So the case of a labor shortage may also be overstated. I have just proven that you can weave a story however you want if you have the data and back it up with your technical view of the markets. And it is believable.

This is happening slowly. So inflation can be controlled by the base effect. Oil prices do not have to go down. They just need to stop rising and maybe rise more slowly so it can be priced in. Oil went from 10$ to 140$ between 1998-2008. It did not create an inflation problem. We overthink. Covid lockdowns, supply-side bottlenecks, and then the China lockdown with Russia sanctions have all fed into the inflation-based narratives, all of which may not be true to the last point. There are holes in every theory. Just like markets never bottom before a recession after a yield curve inversion. Yes, but all that data is based on a period without QE and global liquidity injections at scale. It cannot be compared. If the Central banks back off, then yes, the same model will work as it did in 2000 or 2008. Right now, there is a gap between the cup and the lip.

When global liquidity rises, it can lead to prices going up in a good way. Rising prices are good for stocks and also bring down debt/GDP as nominal GDP rises. All you have to control is the pace. As investors, what should concern us is the environment. If it is easy, then we can be long on every dip in commodities, emerging markets, and precious metals. These bull markets that started in 2020 have resumed, and unless something changed, we are in the long game.

The dollar index fell back below 103.8, the breakout point. Now unless it can sustain above it meaningfully, we are in a dollar bear market back to 89 or lower. It can take a year or years to complete. So this is the long game.

In the end, money will come to India as bond yields stabilize and USDINR tops out. USDINR is close to a triple top near 82.80-83. If it stops here, then I have this alternate wave count that can kick in. Wave 4 is a triangle between 2018-2021. That solves the problem of extending wave 5. Once the rupee starts to get strong, expect a flood of liquidity in India like never seen before.

I have painted an optimistic picture in the face of difficult odds, so here is one last data point from Hedgeye. Their outlook is for growth and inflation to slow down hard into June of 2023, but after the second half of the year, it’s all green lights. So if growth is coming back so strong in the second half, why are we panic-stricken in the first? I think the market is always ahead of economic data, and it is possible that the slowdown has been priced in. The recession happened in 2022 with two-quarters of negative growth, and that has passed. The dollar knows it, and the bond market knows it. Equities are no longer behaving as they did in the last two bear markets. This is precisely what happened in 2020. The data was terrible, but markets started to recover, and in June 2020, Hedgeye also pivoted to bullish. They will do it again. Their own forecasts are already going there. If things have to crash land, we will see it coming and walk away. But by the end of 2022, everyone, including tax-selling and short-selling, has exhausted the selling power needed for a crash. The anxiety meter reflects this sentiment.

The only thing to remember is that the US recovery may be more shallow due to its inflation and debt overhang. But markets are not ready to tip over into another bear market quickly. The sentiment and liquidity conditions point precisely in the opposite direction. Stay bullish against all odds is my cue. The markets are months ahead in discounting these changing metrics because everyone has become wise in an information-heavy world.

20230209